There are four (4) kinds of people:

- Pessimists

- Optimists

- Realists

- Hypocrites

Pessimists see only the bad in life. Optimists look for the good in things. Realists balance both good and bad. Hypocrites don’t have a view about good or bad; they see life as a means to gain benefits for themselves.

Pessimism, optimism, realism, and hypocrisy are how we look at and approach life.

Pessimists stress adversity in whatever scenario. They don’t like surprises of the negative kind; they believe there’s a possible catastrophe lurking around the corner. Pessimists, thus, tend to be over-cautious and avoid adventures. Pessimists hate risk; they’d rather stay far from it if they can’t mitigate it.

Optimists, on the other hand, endeavour for the positive in their daily activities. What pessimists see as dark clouds; optimists see silver linings around those clouds. Optimists believe there’s good even in the worst of anything, and thus are motivated to drive for changes they trust will result in a better world. Optimists embrace risk & dive into adventure, as they trust something great will come out of either.

Realists balance both the good and the bad in their daily lives. If a pessimist, optimist, and realist were facing a tunnel, the pessimist would see a dark tunnel; the optimist would see a dark tunnel with a light at the end of it; and the realist would see a dark tunnel with a light at the end of it and another dark tunnel after it. Realists look for what they think reflects the starkness of reality: that there will always be positive & negative outcomes. Realists plan for the bad and the good. They calculate risks and assess for beneficial rates of return before making their moves.

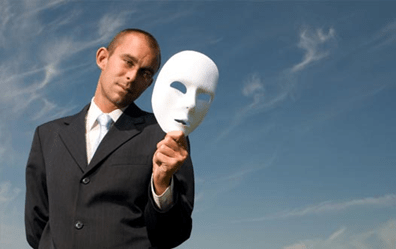

Hypocrites don’t care about the positives or negatives in life; they only pretend they do. Hypocrites will side with either the pessimist, optimist, or realist if they sense some benefit from doing so. Hypocrites don’t see good or bad, nor do they bother to calculate risks or assess rates of returns. They ask questions like ‘what’s in it for me?’, and ‘how can I benefit from someone else’s work?’.

Pessimists won’t jump into a pond; they’ll say it’s too dark or dirty, and likely will catch a cold. Optimists would jump right in, saying the water will be fine and it will be fun. Realists would circle the pond to check its condition and carefully wade in. Hypocrites would wait until everyone had made their decision about the pond, and then jump in and claim credit for the fun, or they will condemn people and say ‘I-told-you-so,’ if something bad happens.

We may brand ourselves as optimists, pessimists, or realists, but we’d be reluctant to identify ourselves as hypocrites. We don’t like to be called hypocrites because we equate them with parasites, traitors, or do-nothing individuals. Being named a hypocrite is an insult, even if many of us are.

The trouble is just as much we are pessimists, optimists, & realists, we are hypocrites too.

Examples:

We ride gas-guzzling jet planes to travel to other cities to join climate change rallyists protesting against fossil fuels.

We bring our pets to be blessed by priests, but we support the same priests when they ban or rid our churches of stray animals.

We commit to teamwork at an employees’ corporate seminar, but we will run to be the first in line at the dining room buffet table.

We complain about motorists stopping suddenly on highways, but we grumble when traffic police won’t let us park in front of the school where we wait to pick up our children as they come out.

We whine about how slow the ticket booth attendant is as we wait to claim free tickets to the local movie theatre.

The big difference between optimists, pessimists, & realists and hypocrites is authenticity. We are honest about ourselves when we are either of the first three, but we would be offended if people call us hypocrites.

Hypocrisy is about not being authentic about our opinions and approaches to life. Hypocrites fake themselves to be pessimists, optimists, or realists so that they will get a cut of the benefits the other three supposedly will get.

Hypocrisy is why we join clubs and make friends with people whom we really don’t care about. Hypocrisy is when we insist our sons join the family business or demand our daughters stop dating boys who we don’t share religious or political beliefs with (or worse, who are of different ethnicity). We notice much hypocrisy when corporate executives and government politicians release rosy press statements about themselves.

But as much as we stigmatise hypocrisy as an evil, we apply hypocrisy purposefully as an alternative to pessimism, optimism, and realism. This is because sometimes we don’t want to show our true colours as an optimist, pessimist, or realise, especially if doing so would lead to confrontations with others who don’t share the same outlook. We, instead, opt to be hypocrites and pretend to be a member of the majority, such that we avoid conflict and have a better chance of getting some benefit out of it.

We are either pessimists, optimists, or realists, based on our outlooks about life. We either see only darkness, light, or the balance of the two, and we would be authentic about it. Hypocrites have no outlook; they don’t see positive, negative, or balance, and pretend to be either of the other three.

Hypocrisy has a bad connotation, but we often are hypocrites, even if we won’t admit it. We become hypocrites to be socially acceptable and benefit from relationships, never mind if we don’t really care about them or we’re just pretending to.

Some people preach against hypocrisy. But it isn’t a sin, as much as it is a way we see and deal with life’s challenges.

In more ways than one, we are all hypocrites.