Our enterprises are under a lot of pressure to comply with Environmental, Social, & Governance (ESG) mandates. Political leaders & activists have demanded that firms pursue sustainability of resources, climate change mitigation, cultural & social diversity, and ethical & legal responsibilities in our workplaces & professional relationships.

So-called pundits (people who call themselves experts or authorities) preach that ESG strategies lead to cost savings and competitive advantage. On the other hand, if we are unwilling to practice ESG in our workplaces, we not only risk government regulators slapping penalties to our enterprises but we also stand to lose trade & community goodwill, which shall translate to lost market share, decline in revenues, and damage to our reputations.

The pundits say we should prioritise ESG particularly in our management of supply chains. Supply chains are where we find many opportunities for ESG, such as in the reduction of fossil fuel emissions, equitable hiring of ethnic minorities, and sourcing of raw materials from socially responsible suppliers. (We should not buy items which lead to rainforest reduction, for example).

One pundit even says there should be a single regulator for supply chains, one who would oversee the processes in the flow of merchandise. Such a regulator would be a “high-level body that will facilitate stronger collaboration between the public and the private sector in setting policies, initiatives, and programs that are required to address constraints and improve supply chain performance.” In short, a government-sponsored authority who would set rules and police the supply chains of businesses.

Many nations have enacted rules & regulations to compel industries to build in ESG practices. Enterprises, big & small, had been paying taxes & fees to support government-led ESG initiatives. There had been more audits & inspections of enterprises’ facilities and there had been more prerequisites before entrepreneurs can secure permits to build, occupy, & operate.

The ESG pundits say these are all okay. They say ESG is a means for a greater good for our planet Earth and for the long-term well-being of our families & communities, not to mention it would be good for our businesses in terms of goodwill. All we need to do is comply. And if we work to comply better than our business rivals do, we shall gain a competitive advantage.

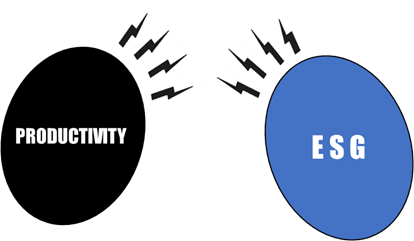

ESG, however, does not contribute to productivity. It does not bring about any improvement to efficiencies, but instead, it drives costs, never mind what the so-called pundits argue. ESG disrupts productivity, if not degrades it. ESG is an enemy of productivity.

ESG is all about compliance to standards governments or communities mandate based on what they perceive as their acceptable standards for the environment and society. The individual priorities of private enterprises are not relevant, nor are they material to what the ESG activists aim to accomplish.

Some environmental groups, for instance, argue enterprises should stop using fossil fuels and tap renewable energies. Via ESG laws, requiring our enterprises to invest in renewal energies like solar & wind power would help mitigate climate change and end coal mining & oil drilling. Our enterprises via ESG would help protect natural resources.

But using renewable energies doesn’t necessarily translate to higher productivity. The sun only shines at night and we cannot control how windy tomorrow will be. Our enterprises would still need traditional sources like fossil fuels, nuclear energy, hydro-electricity, and geothermal power to make up for deficiencies from renewal energies.

But many ESG activists would not accept continuous sourcing of traditional energies. They insist we switch 100% to renewable energies. We must discard the traditional energies. We should pay for the higher costs and just bite the bullet from whatever low return on investments in renewable energies. The idea is to support the ESG agenda, the activists’ agenda, their agenda. Our agenda, which includes continuously improving productivity in our supply chains, are not important.

The same applies for social issues and governance. ESG activists would lobby for regulations that require diversity in our hiring & assignment of employees. Politicians would push for more transparency in our transactions with vendors & customers, to ensure everyone is above board in following ESG laws & standards. It doesn’t matter if the regulations are complicated or would add unproductive steps to our supply chain operations. It’s their laws we should follow; supply chain productivity is not their priority.

Activists & politicians don’t care if our enterprises have to pay more to comply to ESG norms or laws. They don’t care if ESG entails sacrificing productivity. What’s important is what they want, not what we in our enterprises want. Our side does not matter.

Our basic role as supply chain managers is to improve productivity of our operations. Productivity is about progressing efficiently towards whatever priority goals we have set. Our enterprise priorities typically consist of accumulating wealth, attaining competitive advantage, boosting good reputations, and gaining influence.

For our supply chains, we translate these priorities via keeping our delivery promises to customers, conforming to highly set quality standards in what we buy, make, & serve, and in ensuring the highest value in our products & services.

ESG activists don’t empathise with our enterprises’ priorities and our inclinations to improve productivity. Their rationale that ESG enables competitive advantage, better reputational standing, and growing influence, is borne out of illusion.

ESG would mean higher costs in the form of installing & managing not-so-reliable renewable energies. It would cause trade-offs in finding the best talented people versus building in more diversity in our organisations. It would result in more red-tape complexity to comply with governance transparency rules.

ESG is not a catalyst to productivity. It is an impedance. As much as we all want a better world to live in, we should keep in mind that productivity just as much helps in bringing that about just as much as we may believe ESG does too, if not even better.

Productivity via efficiency and progress towards our enterprise goals is about doing more for less, in a direction that benefits just about everybody, given just about most, if not all, of us work in enterprise organisations.

Whereas ESG is about forcing us to comply to rules set by other people’s agenda, productivity is about empowering us to set our own roadmaps to how we better manage resources & change our systems & structures towards mutually beneficial outcomes.

Wouldn’t it be wiser to be more proactive towards productivity than to be told by other people what to do?