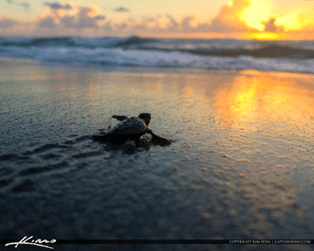

We’re like baby sea turtles when we begin our careers. We don’t know what awaits us as we venture out into the world. We learn to deal with a lot of uncertainty.

A property manager proposed a project to build a warehouse that would require an expenditure of PhP 2,500,000.00 (USD$ 50,000). Three (3) out of five (5) directors of the corporation’s board approved the project. Two (2) questioned the economics, in which both felt it would be better to just leave the money in the bank and earn interest.

In the debate that ensued, the three (3) directors in favour believed the proposed warehouse’s return on investment will outpace the bank interest rate over time, especially after the warehouse investment pays out after an estimated eight (8) years.

One of the minority directors said the PhP 2.5 million would be better invested via financial instruments. The money would earn from growing interest and by dividends, especially if invested in securities, like stocks.

In justifying business projects, we compare alternatives by determining how much money we earn from the investments. We look at the paybacks from the investments in terms of the additional income earned and we evaluate the rates of return versus what it would be if we just did nothing or leave money in the bank.

The trouble with computing paybacks and rates of returns is that we assume certainty in the numbers. We assume that the estimated returns of investment will be what we realise.

In developed countries such as the United States and European nations, many people plan their daily routines with a high level of certainty. Because city traffic is predictable, they would confidently know what time they’ll be at work and what time they’ll be at home every day. People make long-term plans for their families and businesses as they enjoy stable political & economic climates.

For people in not-so-developed countries such as the Philippines (where I live), we deal with a lot of uncertainty. We don’t know what tomorrow will be like, despite what routines we aim to follow. Traffic is as unpredictable as the weather; we don’t know what time we’ll reach our destinations and we don’t know if it will rain today. We plan more for the short-term than the long-term because frequent changes in laws & regulations make for uncertain political & economic climates. Prices fluctuate without warning, taxes rise and fall in short notice, and even contracts are not ironclad as they are subject to fickle legal rulings.

We anticipate uncertainty by building in back-ups and contingencies into our systems and structures. Better flood control, for example, would reduce the probability of inundated roads and traffic gridlocks. We also stash more cash for the so-called rainy days, as hedges against disruptions, whether natural or man-made.

In the warehouse project mentioned above, the corporation operates in the Philippines. Three (3) of the corporation’s four (4) directors who voted for the warehouse live in the Philippines. Two (2) who weren’t warm to the warehouse project reside in America.

We remedy uncertainty by gaining greater influence over our businesses. The directors who favoured the warehouse believed investing in a facility in the Philippines gives the corporation greater control over its assets. The minority two (2) directors could not immediately understand this as financial investments in the USA offer stability and earnings growth. They didn’t see that financial investments in the Philippines are more uncertain in financial returns than in developed countries.

We perceive greater risk with uncertainty simply because we are unsure of what will transpire today to tomorrow. But we can turn uncertainty to an advantage by investing in systems & structures that give us more influence over the results. Having a warehouse where we can decide the price of the lease sounds better than leaving it up to bankers, whom we really don’t know, to determine how much interest we’ll earn from our investments.

The key word is influence, and it’s why I believe it’s a strategic priority that ranks up there with wealth accumulation, competitive advantage, and esteem.

Uncertainty varies from one place to the next, more so between developed and not-so-developed countries. We manage uncertainty by investing in assets that we have greater influence over. And as we gain from the returns from these assets, we also don’t stop seeking opportunities to invest where we can have the same or more influence in what benefits we can gain.